In Mahabharata, one of our greatest epics, Dushashana attempts to disrobe Draupadi in the Kaurava court. While everybody watches in stupefied silence. Draupadi prays to Krishna, who forthwith comes to her rescue. Her saree becomes unending- yards and yards of fabric appear miraculously defeating Dushashana’s evil plan.

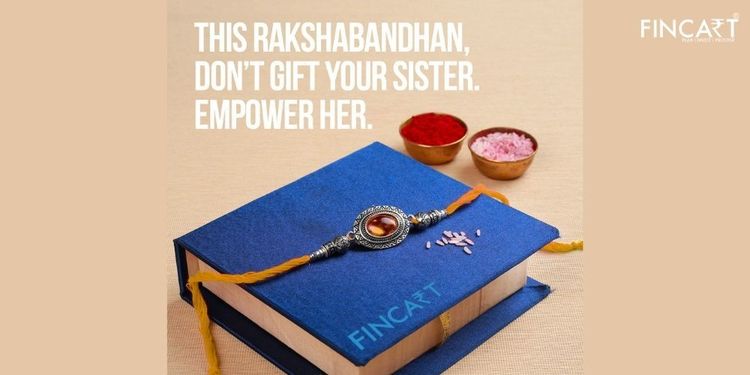

Raksha Bandhan – an unconditional pledge that every brother takes to protect their sister from trouble. This is more than a festival for us. It is our way of life.

All said, ‘Shagun ka Lifafa ’ on this day has a particular relevance and emotional connect, cutting across generations. Much as brothers want to protect their sisters; there are many challenges that today’s women wish to battle and manage on their own. Perhaps, empowering sisters will be a great gift that brothers can present.

This Raksha Bandhan eMpower the “Lifafa” –

1. Introduce her to a financial literacy program 2. Help draw a financial plan for her

Financial Literacy Program

Women have always managed their finances much better. They are yet to get their due credit for their money management skills. Their sixth sense towards “risk assessment” makes them a much better investor. Today’s women have the acumen to be at the driver’s seat and steer money decisions. Brothers must encourage & introduce sisters to money management lessons and help enrol for financial literacy programs.

Financial Planning

Years of social conditioning and patriarchal traditions have put women to a disadvantage when it comes to money matters; but times have changed. The social condition is changing and today’s women want to take this head on. It is time to take charge of the finances. Being financially independent goes a long way in providing a life of dignity.

A good Financial plan not only adds direction towards achieving life’s important goals, it makes one financially confident about money.

A good financial plan spans; Emergency Planning, Risk Protection (i.e.- Health Insurance, Term Insurance & Disability Insurance), Goal Planning, Tax planning, Retirement Planning and Estate Planning.

Emergency Planning – Ideally a minimum of 6 months expenses must be kept aside in Fixed Deposits / Liquid Funds to meet any sudden expenses (good or bad).

Health Insurance / Life Insurance – It may sound very unromantic to gift a life or a health insurance plan but in today’s fast changing life & pandemic scenario it has all its merit.

Goal based Investments – Mutual Fund SIP in Equity to fund long-term goals and Debt Funds for short term goals. For medium term & long-term goals, one can invest in tax-saving instruments to enhance the benefit.

Digital Gold – Digital gold in the form of Gold ETFs or sovereign Gold Bond are much efficient alternatives to the conventional option of physical gold.

Read our previous blog article on the Importance of assest allocation

WILL – write one! It is a simple way to ensure the inheritance passes to the rightful legal heir as per the sister’s wish, in case of any eventuality.

Women of the 21st century wish to be self-reliant; by helping her become financially savvy, it is not implied that brothers commit to fund her goals. Sisters are looking for the care & love from their brothers, more than anything. Be her Krishna.

To the everlasting bond of eternity – HappyRakshaBandhan .

This blog article is co-written by Sarabjit Singh and Tanwir Alam Sarabjit Singh is Senior Vice President, Institutional Sales with IDFC Asset Management Co. Tanwir Alam – Founder & CEO, FINCART.