Table of Contents

Toggle“Unless you’re immortal, you need life insurance”

Death is one of the most unpredictable parts of our life. What we leave behind for our family, matters the most. Being the breadwinner of the family we all worry about the fact that how will our family survive financially when we are not there.

This is the reason Term Insurance policy has gained its importance over the years. As per Statista, there were 28 million new individual policies issued across the country in FY21.

A term insurance plan is a very simple product that turns out to be the biggest asset one could get for its family.

Now since the competition has increased within the insurance market, getting the right term insurance for your family needs to be considered carefully. Well in this blog, we have compiled a list of factors that you should consider before buying the right term insurance:

Plan for sufficient term insurance cover

It is always said that taking the first step is the most crucial step in any life’s decision. Well, this applies in planning for sufficient insurance cover too!

When planning for adequate coverage needs, people tend to pick random numbers like Rs.1 crore term cover. They believe this amount is sufficient for them, but again this might be a mistake too! Financial advisors generally advise buying a policy with a death benefit of at least 8-10 times your gross annual income.

Your coverage should at least cover your family for 30 years to cover your liabilities, your living expenses, and future goals like child marriage, child education, etc. The most important thing is to remember to consider the rate of inflation while calculating the expenses.

policy tenure

What is the primary objective of getting a term insurance policy? Well, it is to replace the income of the life assured in case of the unfortunate death of the breadwinner. Therefore, it is important that you are covered for the whole period till the time you intend to keep working, be it till 55 years or say 65 years.

This tenure does not limit here, but you can opt for even longer policy periods. There are few plans in the market that aims to provide you insurance coverage up to 100 years of age.

The best age to buy term insurance is always said to be at a younger age. This is a wise decision to make as you could benefit from low premiums. It’s not that you could not get a term insurance plan in your 40s or say 50s, you can, but again you’ll be shelling out quite a bit in premiums.

Claim Settlement Ratio of Insurance Company

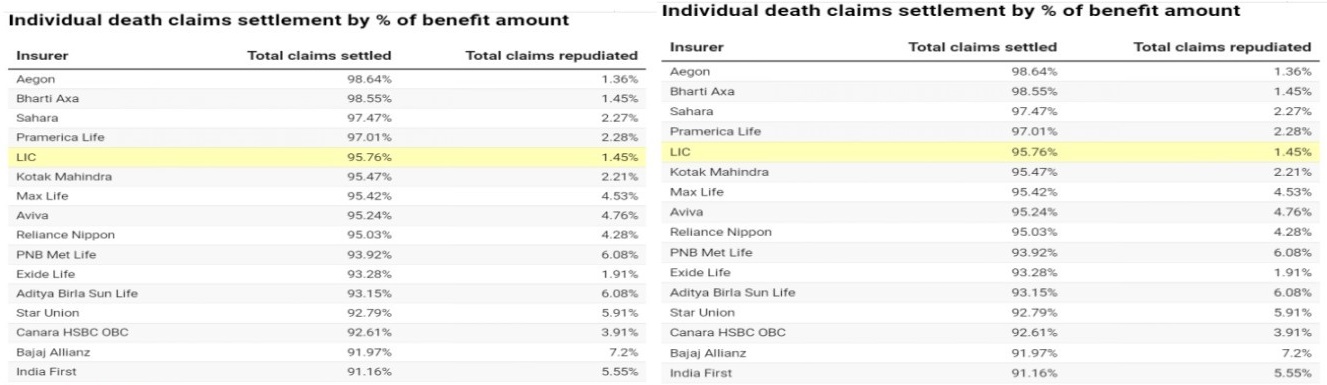

The claim settlement ratio is nothing but an overall number of claims approved by the insurer. This is further divided by the overall number of claims it has received. Now it is crucial to have an idea about this when planning your term insurance policy from a specific insurer.

With the help of this ratio, you would get an idea of how many claims this firm has settled, and accordingly, you could compare it with other insurers. You must now think that where can you avail this data?

Don’t worry! As every year the IRDAI (Insurance Regulatory and Development Authority) releases a report that states the claim settlement ratio of insurance companies in India.

Source: Economic Times

Source: Economic Times

“It’s better to be wise than to be smart”– therefore, it is always a wise decision to go for an insurer who holds a high percentage figure in claim settlement, rather than seeing if the company is greater or not. Higher the percentage more smooth chances of claim settlement.

Insurance Rider

An additional benefit that comes with term insurance is Term Insurance Riders. With this benefit, you could avail of supplementary coverage. Here are some riders to consider:

- Accidental Death Benefit Rider – Under this, an Accidental Death benefit riders pay an additional sum assured to the nominee in case of accidental death of the breadwinner.

- Critical Illness Riders – This cover pays a lump sum amount to the family if the breadwinner has been diagnosed with an illness.

- Income Benefit Rider-Under this, the surviving members get additional income on an annual basis for a period of 5 to 10 years. The most promising aspect under this is it is in addition to the basic sum assured.

- Waiver of Premium Rider-The best thing about this rider is that it works when the policyholder fails to pay the future premiums due to accidental disabilities or loss of income. What happens here is that the term insurance policy remains active and the future premiums are waived off.

If you don’t have this rider and failure to pay the premium under any circumstance would either mean cancellation of the policy. This will lead to no death benefit to your nominees.

Repudiated Ratio

The repudiated ratio simply states how many claims the insurer found to be invalid and hence, did not pay the claimed amount. There are many grounds an insurance company can repudiate a claim after it has accepted it for processing.

Here, the insurer is of the belief that the claim under the contract is not acceptable either due to non-fulfillment of the terms of coverage or due to any fraud/misrepresentation.