These days it seems to be getting harder and harder to manage finances with the rising cost of living. To save money, one needs to live within their means. It’s easy to say this but often many individuals, especially young professionals struggle with it. One may manage to cover their basic needs but at the same time find it challenging to save meaningfully for the future. Finding a balance between enjoying the present and securing tomorrow is what’s needed, and a budget can help with that.

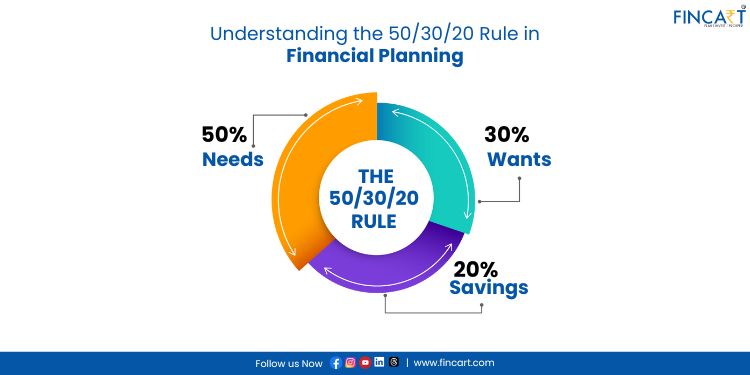

Many people across the world have adopted the 30 20 50 rule of budgeting because of its simplicity. This investment rule 50 30 20 allows you to categorise your expenses into three categories – needs, wants, and savings, which makes budgeting easier. This blog will cover all you need to know about the 50 30 20 budget rule. Let’s go!

What is the 30 20 50 Rule?

The 50/30/20 rule is a budgeting rule that talks about how you can divide your income after tax into three categories – Needs, Wants, and Savings. According to this rule, needs should take up the majority of your income at 50%. Your wants come next, and you should allocate 30% of your income to fulfil them. Finally, you should aim to save 20% of your income for investment and debt repayment related reasons. This rule was made popular by Elizabeth Warren and through it, you can manage your money responsibly while still enjoying life.

The 50 30 20 rule of budgeting is not a rule as much as it is a guideline. That means you can modify this rule as per your financial circumstances. For example, if you are just starting your career, your income may not be high enough to strictly follow the 50/30/20 structure. In such cases, it’s perfectly acceptable to alter the rule to allocate more income to needs and less to wants and savings.

However, you should still try to save as much as possible and start building a savings habit. Similarly, a person wanting to buy a car soon would allocate more to savings and less to wants. As your income increases, you can resist the temptation to spend more on your wants and adjust the ratio to get closer to the 50/30/20 rule.

Why the 30 20 50 Rule is Effective

Following the 50/30/20 rule can help you out in many ways:

- First, it gives you a balanced approach to budgeting. It allows you to cover all necessary expenses, while also letting you use a sizable chunk of your income to make your lifestyle comfortable and more fun. Also, the 20% allocation to savings makes sure that you are working to secure your financial future.

- Second, the rule is quite easy to understand and use. The three categories of expenses make it clear how to prioritise your spending.

- The rule can also be adjusted according to your financial situation. For example, if you live in a metro city with a high cost of living, you can allocate more income to needs and make cutbacks from wants till your income increases.

- Your savings can help you in many ways. You can use them to repay debts, set up an emergency fund, or invest for achieving your financial goals.

- It helps you build a habit of saving money regularly, which is essential for long-term financial success.

- With a 30% limit on wants, you can also control your impulses and avoid overspending on things that are non-essential. The rule helps you stay within your means while also letting you live a fun and comfortable life.

- The wants section also allows you to identify areas where you can make cuts and redirect funds to either needs or savings.

How to Implement the 30 20 50 Rule

You can follow these steps to adopt the 50/30/20 rule:

Step 1 – Understand your income:

The investment rule 50 30 20 applies to your net income, that is, your income after taxes. It’s easier for salaried individuals to follow this rule because they have a fixed income, but self-employed individuals should take special care in implementing this rule. They need to closely track their income and expenses to figure out an average monthly net income, which accounts for taxes and business expenses.

Step 2 – Track your expenses:

A good starting point for tracking is by taking a look at the expenses over the last month or two. Doing so will give you a picture of where your money is going and how well you’re managing it. If it resembles the 50/30/20 structure, then you are on the right path, otherwise, you’re going to have to make many adjustments so your spending reflects the rule.

Step 3 – Categorise your expenses:

Start by identifying the essential expenses. This includes bills, groceries, transport costs, rent, mortgage, and so on. Then, make sure that your non-essential expenses stay within the 30% limit so you can save for your financial goals.

Step 4 – Automate your savings:

A great way to save is by setting up a way that automatically deducts 20% of your income and directs it toward savings, investments, or debt repayments. This eliminates the temptation to spend the money you should be saving.

Step 5 – Be consistent:

A budget is meaningless if not followed consistently. That’s why the 50/30/20 rule should be treated as a guideline rather than a hard and fast rule. If this structure does not match your financial situation, make adjustments otherwise your budget will be unrealistic. Unrealistic budgets are unsustainable. You would follow them for a while making more sacrifices than you need to and ultimately there will come a time when you will lose the motivation to stick to it.

Now let’s take an in-depth look at what the categories actually include.

30% for Wants

Wants are also known as non-essential expenses. As the name suggests, this category covers expenses that you don’t need to make to survive, but those that make your life more enjoyable and fulfilling. Some examples of ‘wants’ are:

- Latest mobile phones, laptops, and other gadgets.

- Non-essential travel such as vacations.

- Non-essential clothing and accessories.

- TV and music subscriptions.

- Hobby expenses.

- Dining out and going out for movie nights.

- Going to concerts and sporting events.

This list can go on and on because these days our wants seem to be unending. One of the reasons why the 50/30/20 rule is so successful is because the 30% limit on discretionary spending is quite generous. It allows you to enjoy life while also helping you maintain a focus on your financial health. This category is also very helpful when identifying areas where you can make budget cuts. If you are unable to meet your savings goals or have run into financial trouble, reviewing your wants can help you adjust your spending.

20% for Savings and Investments

You should aim to save 20% of your income. These savings can be used to pay off any existing debts, build an emergency fund, or invest for the future, preferably in that order. Reducing debt should be a priority because interest piling over time can seriously hurt your finances. If you don’t have one yet, building an emergency fund is also important for several reasons.

An emergency fund is cash you use to specifically deal with unexpected expenses, and because these expenses can pop up at any time, they have the potential to utterly destroy your budget. For example, if your car breaks down, your home needs repairs, or you lose your job, you can run into serious trouble without an emergency fund. When you are dealing with these emergencies, you may not be able to meet your essential expenses, make your investments on time, redeem your existing investments prematurely, or even have to take on debt.

The 50/30/20 rule does not take these expenses into account, that’s why you should save up to six months of your living expenses in a liquid asset such as a debt mutual fund, so you can quickly respond to these unforeseen expenses.

Then, you should focus on investing your savings in vehicles that match your financial goals, risk tolerance, and investment horizon. You can consider options such as Systematic Investment Plans that allow you to make fixed and regular contributions in mutual funds.

The old way of looking at savings was that they are whatever’s left after spending. But that’s not the case anymore. Warren Buffet says, “Don’t save what’s left after spending, but spend what is left after saving.” Savings should be the priority as they will define your financial future.

50% for Needs

Needs are essential expenses and should take up the lion’s share of your budget. You absolutely need to make these expenses in order to survive and maintain a decent standard of lifestyle. Here are some expenses that are considered essential:

- Rent and mortgage payments.

- Minimum debt repayments.

- Insurance premiums.

- Utility bills (water, electricity, LPG, etc.)

- Essential EMIs.

- Groceries.

- Essential transportation and vehicle maintenance.

If you find that your needs take up more than 50% of your income, you’re going to have to make cuts from your wants and save a bit less than 20% till your income increases.

Looking for a Financial Advisor?

Connect with Fincart for personalized financial advisory services and achieve your financial goals with confidence.

Benefits of the 50-30-20 Budget Rule

The 50-30-20 budget rule is a simple yet effective financial strategy that helps individuals manage their money efficiently. It allocates 50% of income to necessities (rent, utilities, groceries), 30% to wants (entertainment, dining, hobbies), and 20% to savings and debt repayment.

One of its key benefits is financial clarity, as it helps individuals prioritize essential expenses while maintaining a balanced lifestyle. It also encourages saving, ensuring future financial security and preparedness for emergencies. By allocating a portion to debt repayment, it supports debt reduction and prevents financial strain.

This method is particularly useful for young professionals and couples as it provides a structured yet flexible approach to money management. It promotes financial discipline, reduces stress related to overspending, and helps build wealth over time. Following the 50-30-20 rule ensures a sustainable and responsible approach to personal finance, leading to long-term financial stability.

Conclusion

The 50 30 20 rule of budgeting is a guideline which states that 50% of your income should be used to meet essential expenses, 30% to cover non-essential expenses, and the remaining 20% should be saved for investment or debt repayment purposes. Since this is a guideline, you can make small adjustments to it based on your financial situation and goals. The importance of having an emergency fund should not be underestimated. Budgeting doesn’t take unexpected expenses into account, so you should use your savings to slowly build an emergency fund that can cover six months’ worth of your living expenses.

Also, the success of the 30 20 50 rules of budgeting depends on several factors, such as, how well you stick to the plan, how easily you can adjust it when your financial situation changes, and how clearly you can tell the difference between wants and needs. Some people struggle to separate wants from needs, which leads to overspending and derails their budget. If you need help with personal finance, you should consider meeting up with a financial planner.

Financial planners provide a holistic service which includes advice on budgeting, investing, risk protection, emergency planning, retirement financial planning, and tax saving. They create elaborate personalised plans that help their clients realise their financial dreams. Budgeting is how you tackle finances on a daily basis, so with help from a planner, you can make sure that you prioritise your needs, wants, and savings effectively.