Find an investment or tax advisor worthy of your trust

Find an investment or tax advisor worthy of your trust

With our expertise and experience in advising clients on portfolio creation, we match your goals with financial investments that help you in realizing them.

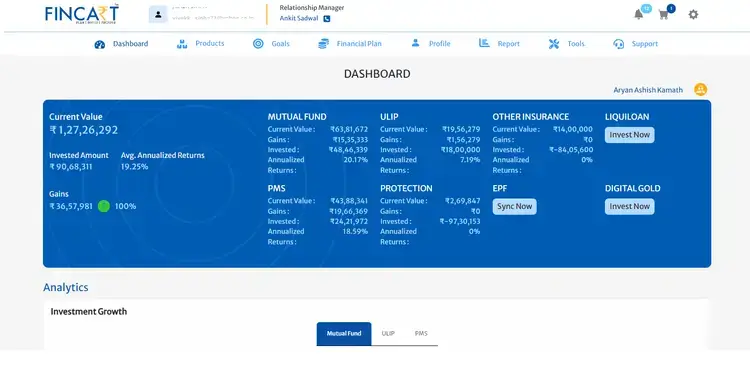

Once a plan has been created, it is time to put it into action. Our technology platform makes it easy to invest in different asset classes and track your portfolio performance.

Wealth creation is not a one-time activity. Our team carefully looks at rebalancing opportunities so that your portfolio performs as per plan.

Fincart is a financial planning and advisory platform that helps individuals and businesses manage their finances effectively. It offers a wide range of services, including investment planning, retirement planning, tax optimization, and insurance analysis. With a user-friendly interface and personalized recommendations, Fincart empowers users to make informed financial decisions. Its goal is to simplify financial management and provide clients with the tools they need to achieve their financial goals. Whether you’re saving for retirement or planning for a major purchase, Fincart can assist you in reaching your financial milestones.

A plan that takes a holistic view of your short and long term financial goals. Our

experienced advisors create a detailed plan that helps you achieve them.

Financial Planning includes setting financial goals, planning for taxes, building an emergency fund, managing debt, planning for retirement, and creating an estate plan.

The goal of investment planning is to strike a balance between risk and reward. An investment advisor can create a diversified portfolio that maximizes potential returns.

Goal-based investing solely focuses on your Dreams and Aspirations. It enables you to allocate your hard-earned money to achieve all your short, medium, or long-term goals.

Life is unpredictable, but your finances don’t have to be. Risk management helps you safeguard your assets, mitigate uncertainties, and stay financially resilient — no matter what lies ahead.

We believe in empowering you to enjoy the retirement phase of your life that is free of financial worries or constraints.

We offer a suitable tax-saving plan that can help reduce the burden of taxes and maximize your savings. Such investments help you save taxes and still earn equity linked returns.

We prioritize delivering customized, innovative solutions to drive our clients’ growth. Our approach sets us apart, as we don’t rely on generic strategies. Instead, we develop specific plans to ensure our clients reach their goals. We guarantee that you accomplish in:

Emergency Fund Planning

Insurance Planning

Achieve Your Goals Confidently With Planned Investment.

Live A Dignified Retired Life With Apt Retirement Planning Solutions.

Transfer Your Hard-Earned Money In The Most Tax Efficient Manner.

Plan & Save Taxes & File Your Income Tax Returns On Time.

There are more than 10,000 financial products. Based on research, our team selects a handful of investment instruments as per your risk profile & life goals.

mutual funds

life insurance

fixed deposits

health insurance

alternative investment funds

digital gold

portfolio management services

Watch our video to answer your questions of common fear.

Your goals are important to us. We track & navigate investments based on market movements, so that you reach your life financial goals, surely & safely.

We are accountable for your money. Our trained professionals take complete responsibility of helping you achieve your goals. They help you plan, invest & navigate your investments to the right direction.

Our Number Speaks For Us

| Within 1 Yr | Within 2 Yr | Within 3 Yr |

|---|---|---|

| 1.50% | 1.00% | 0.50% |

Navsheen is an expert in Wealth Management and currently serves as a Wealth Manager at Fincart. She holds a Master’s degree in Business Economics and prestigious certifications including CPWM (Certified Private Wealth Manager) and multiple NISM certifications (V(A), XXI(A)), underscoring her deep expertise in wealth management and regulatory compliance.

With over 4 years of experience in financial planning and portfolio management, Navsheen has successfully managed the portfolios of 100+ families, offering personalized financial strategies and guidance. Her commitment to staying abreast of industry trends and best practices makes her a trusted advisor for individuals looking to secure and grow their financial future.

[contact-form-7 id=”aae01c7″ title=”Contact form 1″]

Manu Choudhary is a Senior Wealth Manager at Fincart, with over three years of experience in wealth management. She holds the Certified Private Wealth Planner (CPWP) designation from CIEL and NISM V-A certification.

Manu manages the financial affairs of more than 70 families, specializing in tax, estate, investment, and retirement planning. She crafts personalized strategies that cater to both immediate and future goals, prioritizing trust and relationship-building in her approach. Committed to guiding clients through every phase of their financial journey, Manu offers expert advice and handholds her clients, makeing a positive impact, ensuring long-term success and financial confidence.

Akanksha Aggarwal is an esteemed financial professional, serving as an Associate Vice President at Fincart. With a strong background of over 8 years in wealth management her commitment to client success, makes her a trusted advisor for a broad spectrum of clients.

Armed with advanced certifications in financial planning and wealth management such as Certified Private Wealth Manager by CIEL, IRDA, and NISM certifications.

Akanksha is well-equipped to navigate the complexities of tax, estate, investment, wealth, and retirement planning. Her focused and goal-oriented approach and hunger to keep improvising make her a one-of-a-kind purposeful advisor.

Introducing Ankit Sadwal, a dynamic leader in the financial services industry with over 6 years of experience in wealth management and financial planning. As the Associate Vice President at Fincart, Ankit brings a wealth of expertise in crafting personalized financial strategies that align with his client’s long-term goals.

Ankit’s academic credentials include a degree in Bachelor of Commerce and he holds advanced certifications such as CWM and NISM, showcasing his dedication to continuous learning and professional growth. His client-centric approach and deep understanding of market trends have made him a trusted advisor to a diverse clientele. His strategic insights and unwavering commitment to excellence position him as a key player in the dynamic landscape of wealth management.

Vivek is an accomplished corporate professional with an MBA in Marketing and extensive experience in Sales & Business Development across multiple industries. As the Head of the Corporate Vertical and Workshop coordinator for Fincart, he has led numerous successful initiatives, driving growth and fostering strong client relationships.

With over 300+ hours of workshop facilitation, he has honed his ability to engage diverse audiences, providing valuable insights and practical solutions. His leadership in the corporate sector is marked by a deep commitment to empowering businesses and individuals through tailored financial education and awareness programs.

Ambika Sharma is an established financial advisor with over 5+ years of experience in wealth management. She specializes in helping high-net-worth individuals and families achieve their financial goals through tailored investment strategies, estate planning, risk planning & Tax planning and retirement solutions.

Ambika is known for her deep understanding of market trends, her ability to simplify complex financial concepts, and her commitment to client education and empowerment. Ambika believes that financial success is not just about accumulating wealth, but about creating a secure and fulfilling future. She is passionate about educating her clients and empowering them to make informed financial decisions. Her client-first approach and dedication to excellence have earned her a reputation as a trusted advisor in the finance industry.

Ratan Priya is an accomplished Certified Private Wealth Manager and Senior Team Lead at Fincart, possessing over a good number of years of experience in wealth management. She holds a degree in B.Com (Hons) from the University of Delhi. Ratan also holds advanced certifications such as the Certified Private Wealth Manager (CPWM) and NISM V(A).

Leading a highly skilled team of wealth managers, Ratan Priya demonstrates expertise in tax, estate, investment, and retirement planning, providing customized strategies aligned with clients’ long-term objectives. Ratan Priya is dedicated to supporting clients throughout each phase of their financial journey, offering personalized, strategic counsel focusing on long-lasting success.

Yash Tawri is a seasoned Senior Manager in Wealth Management with over 3 years of experience in delivering expert financial strategies and managing high-net-worth portfolios. With an MBA in Finance and Investment Banking and advanced certifications such as the Certified Private Wealth Manager (CPWM) and NISM V(A), Yash brings a wealth of knowledge and practical expertise to the financial sector.

As a sought-after speaker, Yash leverages his deep understanding of investment strategies, financial planning, and team leadership to provide valuable insights into the world of wealth management. His presentations are known for their clarity, actionable takeaways, and real-world applications, making complex financial concepts accessible to diverse audiences.

Vivek, the bright star of the Fincart team. He is an expert in Wealth management and currently serves as the Assistant Vice President. Vivek holds prestigious certifications including CPWM (Certified Private Wealth Manager) and various NISM certifications (V(A), XXI(A), X(A), X(B), XVII), highlighting his expertise in wealth management and regulatory compliance.

Leading a dedicated team of 10 wealth managers Vivek’s leadership and strategic acumen are pivotal in delivering tailored financial solutions and driving client success in wealth management.

Anmol is a seasoned Certified Financial Planner and Assistant Vice President at Fincart, bringing over a decade of experience in wealth management. She has earned her financial planning credentials from the University of Florida and holds the Certified Private Wealth Manager (CPWM) designation, along with NISM degrees.

Leading a dedicated team of wealth managers, Anmol excels in tax, estate, investment, and retirement planning, offering tailored strategies that align with clients’ long-term goals. Anmol is devoted to guiding clients through every stage of their financial journey with personalized, strategic advice and a focus on enduring success.

Ravi is the co-founder and director at Fincart, with over a decade of experience in wealth management Read more. He holds an MBA in Finance, a postgraduate diploma in financial planning and wealth management, a licentiate in Insurance, and has earned his domain-related certifications from NISM.

Ravi is one of the youngest and most successful wealth managers in the country. He currently manages the team of 80+ weath managers and financial advisors across four metro cities – Delhi, Bengaluru, Kolkata & Mumbai. His approach emphasizes trust and relationship-building, with a strong commitment to community impact through active societal contributions.

We use cookies to improve your experience on our site. By using our site, you consent to cookies.

Manage your cookie preferences below:

Essential cookies enable basic functions and are necessary for the proper function of the website.

Statistics cookies collect information anonymously. This information helps us understand how visitors use our website.

Google Analytics is a powerful tool that tracks and analyzes website traffic for informed marketing decisions.

Service URL: policies.google.com