Table of Contents

ToggleBillionaire investor Charlie Munger, the Vice Chairman of Berkshire Hathaway and a long-time friend to Warren Buffet, passed away on November 28, 2023 at the age of 99. Munger was born on January 1, 1924 and would have indeed turned 100 on the New Year’s Day in 2024. He was no less than an era in corporate America and investing.

Responding to his death, Buffet acknowledged the essential role played by Charlie Munger in the success of their conglomerate. Munger played a crucial role in turning Berkshire into an investment powerhouse with a market cap of $780 billion (as of November 2023).

His wisdom, inspiration and participation were one of the major reasons for the unmatchable growth of Berkshire Hathaway.

Charlie Munger’s Background:

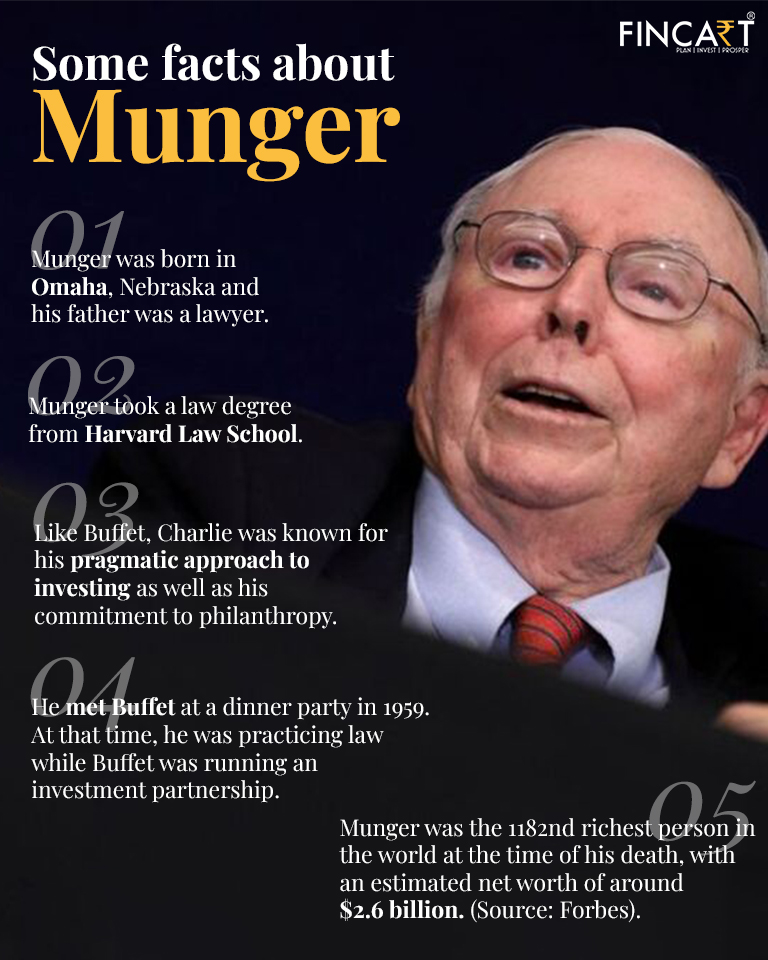

Born in 1924 in Omaha, Munger worked at Buffett & Son grocery store as a teenager. The store was owned by Buffett’s grandfather.

During World War II, he studied mathematics at the University of Michigan but left college to serve in the U.S. Army Air Corps as a meteorologist. He later continued to study meteorology at Caltech.

Munger then graduated magna cum laude from Harvard Law School in 1948 and founded Munger, Tolles & Olson, a renowned law firm.

Transition to Finance:

Warren Buffett and Charlie Munger’s friendship dates back several decades.

Munger met Buffet at a dinner party in 1959. At that time, he was practicing law while Buffet was running an investment partnership.

Munger shifted from law to finance on Buffett’s advice in the 1960s. They became good friends before becoming formal business partners.

Munger also ran his own investment firm, achieving a compound annual return of 19.8% (1962-1975).

He later joined Berkshire Hathaway in 1978 as vice chair.

Munger’s Influence on Buffett’s Investing Philosophy:

Munger influenced Buffett to move away from “cigar-butt” investing (an approach that involves buying distressed business). In fact, Munger played a great role in changing his perspective. He emphasized buying great businesses at fair prices rather than troubled businesses at bargain prices.

He assisted Buffett in diversifying his investment approach and emphasized on identifying high-quality companies that were undervalued.

Munger’s Investment Philosophy:

High ethical standards were integral to Munger’s philosophy and success.

As previously stated, he advocated for buying wonderful businesses at fair prices.

Impactful Investment Decisions:

One of the most impactful decisions by Munger was when he persuaded Buffett in 1972 to purchase See’s Candies for $25 million.

Even though the California candy maker had annual earnings of only about $4 million at the time, it turned out to be a highly profitable investment producing more than $2 billion in sales for Berkshire.

Berkshire’s “Four Giants”:

Munger, as vice chair, managed assets, including the “Four Giants” of Berkshire:

Insurance Float: Subsidiary insurance companies, growing from $19 million to $164 billion.

Apple, Inc: Berkshire’s 5.8% ownership stake due to Apple’s stock repurchase. (Even though Berkshire’s percentage ownership is lower, the investment is still considered great.)

BNSF (Burlington Northern Santa Fe Corporation): Freight railroad network in North America.

BHE (Berkshire Hathaway Energy): Portfolio of locally managed businesses in the utility sector.

Munger’s Views on Bitcoin:

Munger expressed skepticism and criticized Bitcoin, calling it a creation “out of thin air” and a go-to payment method for criminals. He was known for considering cryptocurrencies as “worthless” and had been vocal about his concerns regarding their potential harm.

Philanthropy:

Munger focused philanthropy on education, making significant donations to various universities. During his lifetime, he made large donations to the University of Michigan, Stanford University and the University of California, Santa Barbara.

Some famous quotes of Munger

Here are a few most famous Charlie Munger’s quotes on investing and life:

“I think a life properly lived is just learn, learn, learn all the time.”

“The big money is not in the buying or selling, but in the waiting.”

“There is no better teacher than history in determining the future… There are answers worth billions of dollars in a 30$ history book.”

“The best armor of old age is a well spent life preceding it.”

The bottom line

Munger played a crucial role in Berkshire’s growth into a giant holding company. His investment philosophy and ethical standards were key to his success and Berkshire’s success. The principles adopted by him shall serve as an investment guide for generations to come.