Table of Contents

ToggleStarting with his new job, Akshay wanted to save money for his future. So he decided to divide his income. He kept aside some for his monthly expenses like rent, electricity bill, and Wi-Fi bill. He further separated money for his ‘wants’, things he wanted to spend on. For example, getting a new mobile phone or a laptop, etc. Rest assured he separated some for his savings.

I’m sure we all have done this and eventually, we ended up spending our savings as well. Was this the right way? Well, let’s say, somewhat! In this article, we’ll be going over 3 simple steps to build your wealth. Let’s understand the right way!

To accumulate wealth over time, you just need to follow these 3 golden rules:

RULE 1- EARN MONEY

Earning more money than you spend is the cardinal rule to saving & wealth creation. A small amount of money regularly saved and compounded over time will end up adding a substantial amount of wealth. The most budget goes hay-wire funding Lifestyle expenditures. If you are saving more than 20% of your money, then kudos to you. Keep it up, as this disciplined approach is a cornerstone of successful wealth management.

I am really worried about people who do not have lifestyle expenditures, yet struggle to save. They earn just enough to meet their necessary living expenses.

Enhance your income by enhancing your skill set. Check out all the courses you can take to enhance your skills within your profession! Various online classes are providing skill-based courses at a minimal cost like udemy, and skillshare. There are various certified Google courses too.

You could learn new things too. For instance, if you are a Graphic designer, learn more than the basics. Learn about UI/UX designing Motion Graphics or AI.

Learning something new always benefits you. Don’t stop yourself from learning. In your career, your income will depend on your skill set and learning.

So, Learn more earn more!

Also Read: 5 Safe Ideas of Wealth Creation for Safe Investment

RULE 2- SAVE MONEY

Now as you are making a good amount of money, the other step is to SAVE. You might think that, ‘Oh! This is so easy, I could easily do that.’ Well, ask yourself honestly that, can you?

Saving is only successful when you maintain a monthly budget plan. Let’s tell you how it is done-

Budget down your spending into two factors; your needs and wants

Make a budget of your expenses into two parts. One would be your Household expenses and the other would be your Lifestyle expenses. Within your household expenses, keep aside your rent, electricity bills, groceries, wifi bills, etc.

Most people follow this formula: Income – Expenses = Savings.

It’s the time you reverse the formula: Income – Savings = Expenses.

Saving before you spend is a good way to successfully set aside the money before it gets spent. You can automate your savings by starting a systematic investment plan.

Others who are not able to save can correct their over-spending habit by following the 3 Envelope formula.

Follow the 3 envelope rule

This simple formula may sound a bit regressive or old, but following this conventional practice will help you break the over-spending habit.

Take 3 envelopes, and add 50% of your monthly salary to your household expenditure, 25% to your lifestyle expenditures, and the other 25% to your savings.

1. This exercise comes with a few rules.

You can’t transfer any amount of money from one envelope to another. In other words, you can’t use the amount from your savings to spend it within your lifestyle expenditure.

2. You are not allowed to use your debit or credit card for some time, until and unless you form a habit of saving!

RULE 3- INVEST MONEY

Congratulations! You are now successfully saving money. I would like to highlight a simple secret to wealth creation – the power of compounding.

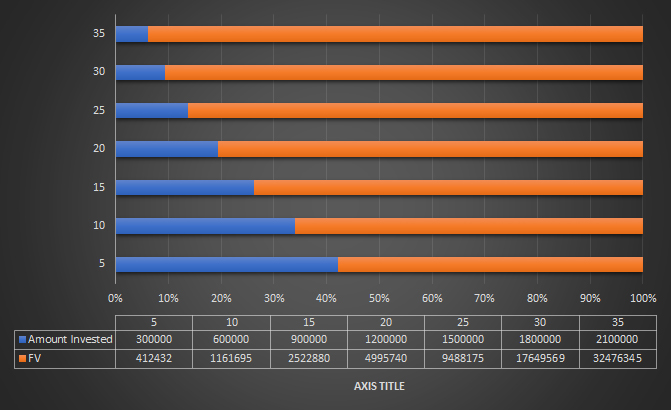

A = P (1+R)^N It is not investment Returns (R) alone but the investment time horizon (T) plays a more crucial role in compounding your investment to create substantial wealth.

The power of compounding works exceedingly well over a very long period. It does not efficiently work for an investment time horizon of fewer than 5 years. Hence, we must not blindly chase returns.

For goals of less than 5 years, the focus must be to generate post-tax returns that beat inflation.

For example, Akshay invests 5000 every month with an annual return of 12%.

BOTTOM LINE

Try to follow these 3 rules for building your wealth. You can’t build your wealth in 2-3 months. This procedure takes time and consistency. However, you will eventually reach the pinnacle of successfully building your wealth.

Also Read: Why is Wealth Creation an Integral Part of Financial Planning?