Table of Contents

ToggleBeing an Indian citizen and taxpayer of the country, it is important to look for yearly changes in taxation norms. As mentioned in Chapter VI A of Income Tax Act, 1956, you can save or say, claim up to Rs. 1,50,000 based on various deductions. It is very crucial for you to know how to claim these deductions, thus, lowering your tax liability!

There are ample sections present but in today’s blog we’ll be discussing the mentioned below sections briefs:

- SECTION 80D: Deduction for the Premium Paid for Health Insurance

- SECTION 80C: Deduction On Investments

- SECTION 80CCD: National Pension Scheme (NPS)

SECTION 80D: Deduction for the Premium Paid for Health Insurance

Having health insurance serves two purposes like financially backing you and your family and secondly, a great source for tax saving.

Under this section, you can claim a deduction of Rs. 25,000 for self, spouse, and children. Not only this, there is an additional deduction for your parent’s insurance that is available up to Rs. 25,000 less than 60 years of age.

If your parents are aged above 60 years then the deduction amount is 50,000. This deduction amount was increased in Budget 2018 from Rs. 30,000. In a scenario where both the taxpayer as well as the parents are aged above 60 years or above, then the maximum deduction one can claim is Rs. 1 lakh under section 80D.

For instance, if you are 65 years old and your father’s age is 85, in this scenario, the maximum deduction for you would be Rs. 1,00,000.

SECTION 80C: Deduction On Investments

The option to invest and save taxes is a combination that every taxpayer benefits from.

Among all the sections, Section 80C is one of the most popular and favorite sections. This is because it allows reducing taxable income by making tax-saving investments. Every year it allows a maximum deduction of Rs. 1.5 lakhs from taxpayers’ total income. This deduction benefit is both for individuals and HUFs. Therefore, the companies or say the partnership firms, LLBs cannot avail this deduction benefit.

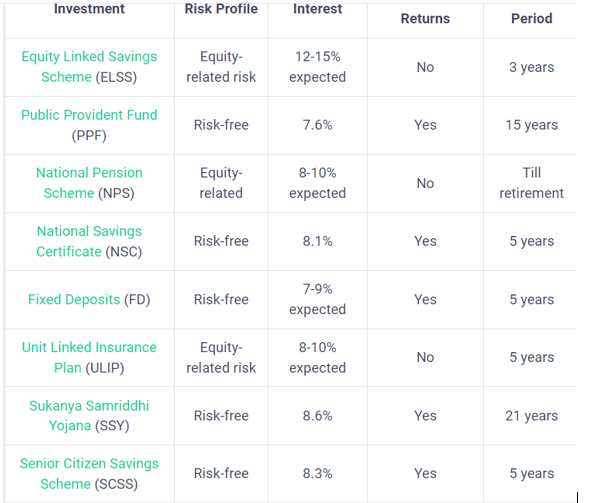

Not all investments fall into the eligibility category of claiming the deduction, mentioned below are some investments that are eligible for deduction under Section 80C:

Source: Groww

SECTION 80CCD: National Pension Scheme (NPS)

NPS, National Pension Scheme is known to be a voluntary pension scheme that is set up by the government of India. This scheme focuses on helping investors to save for their retirement pension and creating a corpus for old age. The best part with this scheme is that it works like a saving-instrument tool that encourages people to save during their work years to lead a healthy financial life post-retirement.

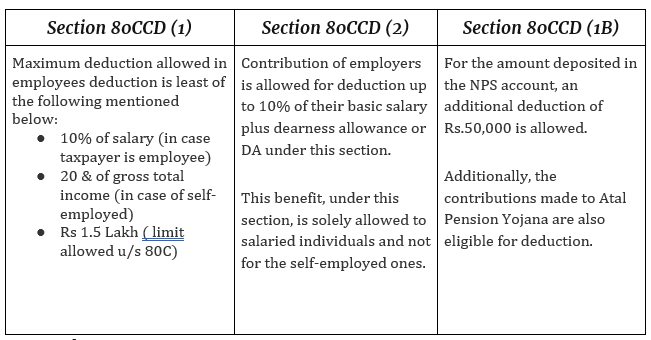

Tax benefits on the NPS can be claimed through the 3 sections mentioned below:

Source: ClearTax

BOTTOM LINE:

Tax filing is something and saving from tax is another thing, for this one should have an idea of how they can save corpus from tax. By availing of the above-mentioned deduction, you could end up claiming major deductions. It is advisable to use these investment opportunities effectively in order to save taxes from them.