Table of Contents

ToggleWhat Are Child Education Plans?

Child Education Plans are financial products designed to help parents secure their child’s educational future by systematically saving and investing. These plans typically combine investment and insurance, ensuring funds are available for critical milestones in the child’s education, even in the policyholder’s absence. They offer maturity benefits that align with the child’s academic needs, such as school fees, college admissions, or higher education expenses. Some plans also provide partial withdrawals to cover periodic costs.

With features like flexible premium payments, tax benefits, and inflation-adjusted returns, Child Education Plans are a reliable way to prepare for rising education costs while ensuring financial security.

Why Do We Need a Child Education Plan?

A Child Education Plan is essential to secure your child’s academic future amidst rising education costs. It ensures the following benefits.

Combat Rising Education Costs: Helps parents manage increasing school, college, and higher education fees effectively.

Financial Security: Ensures funds are available for critical academic milestones like college admissions or overseas education.

Life Insurance Coverage: Provides financial support for your child even in the absence of the policyholder.

Systematic Savings: Encourages disciplined saving and investment to build a dedicated education corpus.

Inflation Protection: Helps offset the impact of education inflation with higher returns over time.

Peace of Mind: Ensures your child’s aspirations are not compromised due to financial constraints.

“One of the best investments we can make in a child’s life is high-quality early education”- Barack Obama

Education inflation refers to the gradual and ongoing rise in the cost of education, including tuition fees, textbooks, and other related expenses, over time. This inflation is often higher than the general rate of inflation, making education increasingly expensive for students and their families.

Education is a fundamental right given to all, but not everyone can afford it. Especially, when the child education plan costs have resulted in one of the biggest cash outflows for families. This rise in education inflation has majorly hit the middle class. And why won’t it, as education inflation is high with 10-12% over the years, unfortunately, it’s double household inflation!

Data suggests that in India, the literacy rate from pre-independence has increased to 77.7% from 12%. As more and more people are getting literate, they are understanding the need for good education. Indians have seen the fact that education has helped to change the lifestyle of people in a better way!

But again, good higher education leads to higher education corpus. To avoid the unimaginable scenario of lack of funds, it is very crucial for you to roadmap your journey ahead & take the right steps for building your child’s education corpus:

Set a Goal Amount for Your Child’s Higher Education Plan

Over the years education inflation saw a rise of 10-12%. Considering this, setting a goal for your child’s higher education is extremely important. Often, there is uncertainty on how much to save for diverse courses like MBA, Engineering, Master courses, etc.

Although parents do wish to have their children join government colleges, sometimes even being a good student, your child, unfortunately, might not get selected. And that is completely okay, as the competition is on an extreme level.

Now the general fees pertaining to these courses range from Rs. 2.5 lakhs to say up to Rs. 15 lakhs per annum. Not only this, in addition to this around 20 percent of the tuition fees will go for other expenses too! These expenses include accommodation, extracurricular activities, etc.

The next step would be to start a regular SIP and let the power of compounding work for you!

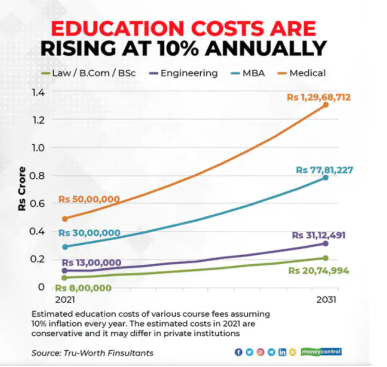

Keep an account for education inflation

Source: Moneycontrol

Among medical inflation, education inflation too has taken a high road in costs! To justify this, a great example could be the IIM Bangalore’s MBA Programme that last decade used to cost around Rs.13 lakh and now it stands over Rs.23 lakh for only a two-year course. The amount has doubled.

If this is the cost now, then imagine what could be the cost in the future. Considering this double in cost, a 4-year engineering course that now costs around 12 lakhs will go up to more than 31 lakhs in 2032, around 61 lakhs by 2039, and so on! This is just the case if your child desires a course in India, what if they wish to avail themselves of a course in foreign universities?

Consider education inflation seriously, as it might hinder your child’s future! You could save yourself from this education inflation with a proper child education plan.

Effects of Inflation on Education!

Inflation can make education more expensive over time. India has been witnessing education inflation over the past years. When prices go up, the cost of things like school fees, books, and supplies also increases. Families may find it harder to afford education, and students might need to borrow money for college/higher education. Inflation can affect teachers too, as their salaries may not keep up with rising living costs. This makes it challenging for everyone to access and provide quality education.

How to Calculate Inflation Rate in India?

The inflation rate of education in India is subject to change and can differ between states and educational institutions. It typically indicates the percentage increase in the total cost of education, covering expenses like tuition, books, and other related costs. To calculate the inflation rate, the education costs of current year are compared to that of the previous year and the resultant percentage increase is looked at.

Looking for a Financial Advisor?

Connect with Fincart for personalized financial advisory services and achieve your financial goals with confidence.

Take the Assistance of a Financial Advisor

A financial advisor is like a guiding light that helps to cross the hurdles in your journey toward achieving your financial goal. When it comes to child education plans, financial planners focus on emphasizing flexibility in their investments.

For the major initial years, they focus on enhancing your wealth to beat education inflation. With this, they focus more on equity, and as you are approaching your goal, they restructure this investment towards a hybrid fund and simultaneously towards debt!

The main purpose of this restructuring is to not only grow your wealth but to protect it too, in its later stage. A financial advisor guides you throughout your journey and they help you achieve your financial goals with a customized financial plan and approach!

Bottom Line:

Getting a Child education plan not only helps in securing your child’s education but also saves you from spending extra as the education inflation will rise in the coming years. Regular investment in the form of financial goals can do wonders in your life as well as your child’s!

faq's

Inflation makes everything expensive. When it comes to education, it means higher costs for tuition, transport, living, books, and research facilities. Just like any shopper, students feel the impact of inflation on the prices of things they need for education.

On average, it costs around Rs 36-38 lakh to raise a child in India from birth to age 21, with a significant portion spent on education.

Inflation makes education more expensive by raising the overall cost of studying. It also impacts hidden costs like buying books, living expenses for international students, uniforms, transportation, and entrance exam fees.

Several factors can contribute towards education inflation, for example, government funding cuts, a rise in the cost of living, increased tuition fees, administrative expenses, modern school infrastructure, and technological advancements.

The education inflation rate in India was 3.34 percent in September 2021, but it has gone up to 5.68 percent in the corresponding month of 2022.