Table of Contents

ToggleTax filing is often assumed to be elective and unnecessary for some. However, the Government of India has made it mandatory for all the people to pay tax who are eligible & come under the tax slab. Unfortunately, many people are not aware that INCOME tax filing bears amazing benefits for taxpayers. Hence, they either don’t file it, or their procrastination lets them be the victim of facing a penalty! Well, to guide you better, in this blog we will be discussing the mentioned below topics:

What is an income tax return & why is it important to file an ITR?

Income Tax Return, commonly known as an ITR, is a form that needs to be submitted to the Income Tax Department. ITR contains basic information like a person’s income and the taxes that need to pay on it during the year. ITR could be filed either online or manually. The source of income might be different, check out the various forms such as

- Income from salary (salaried employees)

- Profits and gains from business and profession

- Income from properties

- Income from capital gains

- Income from other sources such as dividends, interest on deposits, royalty income, winning on lottery, etc.

Who is required to file ITR?

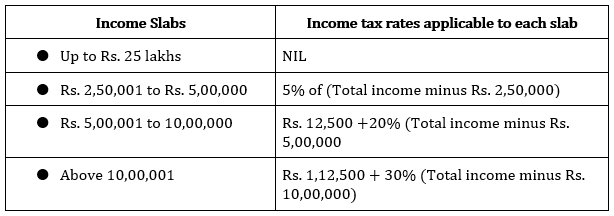

You are obligated to file an ITR if your annual income comes under the mentioned tax slab:

Income Tax Slabs under the existing and old tax regime

Apart from this, there are other instances too when you should file an ITR if your total income has exceeded the basic exemption limit during the financial year. However, in a scenario where your gross total income does not exceed the basic exemption limit then the following are the points you need to consider: a) If your amount exceeds Rs 2 lakh on yourself or any other person for travel to a foreign country then you are liable to file ITR b)

If you have deposited more than Rs 1 crore in one or more current accounts maintained with a bank then you are liable to file ITR c)If your electricity bill has exceeded Rs 1 lakh in a single bill or on a yearly basis during the financial year then again you are liable to file ITR.

Also Read: Benefits of Filing Income Tax Returns on Time

What is the penalty for ITR late filing?

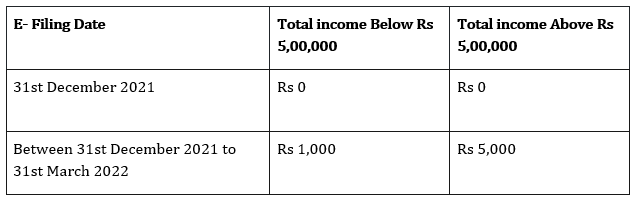

If you are under the belief that by not filing an ITR you’ll be safe, then, unfortunately, this belief is wrong. Mentioned below are the charges that are associated with a delay in your ITF filings:

-

Penalty Under Section 24F

With the changed rules, now under section 234F of the Income Tax Act, an ITR filed past the deadline will make you liable to pay a penalty of Rs. 5,000. This penalty amount has been reduced from Rs. 10,000 to rs. 5000.

-

Late Filing Fee Details

-

-

Reduced Time for Revising Your Return

When things are done in a hassle, mistakes tend to happen. Therefore, under the changed rules you only got time till the end of the assessment year to make the following changes. Gone are those days when taxpayers were allotted a 2-year long window to revise and resubmit their ITR filing.

-

-

Payment of Interest

As per section 234A, if you do not end up filing your tax returns on or before the due date then you will be liable to pay an interest of 1% every month or part thereof on the same amount. After the due date, the calculation of the penalty starts. Don’t wait too long to submit your ITR!

-

-

Carry Forward of Losses is Not Permitted

If by any chance you have incurred a loss during the year in your business, then you have to make sure to file your return within the due date. If not then it will deprive you of carrying forward these losses for the next year. So, it is a necessary step to take, and make sure you take it.

-

-

Delay in Receiving Refunds

Not filing ITR results in delaying your receiving refunds from the government for the excess taxes you have ended up paying. If you wish to receive your refund without any delay then make sure you file your return before the due date.