Table of Contents

ToggleCigarettes are one of the most consumed forms of tobacco! The packet of smoking states the fact that Smoking Kills, but eventually a large segment is involved in smoking.

Therefore, the Best health insurance companies made sure to provide cover to smokers as well. Did you know that in 2020 the Indian cigarette market has reached a valuation of INR 55 Billion? Well, surely the tobacco industry is growing but still, people are lost in a myth stating that smokers don’t get the benefit of Health Insurance.

According to a new survey conducted, nearly one-third of the respondents said that they didn’t go for an online health insurance policy as they believed that their application will get rejected. But little do they know that health insurance companies do offer coverage to smokers. Though, the terms and conditions are different as compared to non-smokers. Well, in this blog, we’ll be discussing the mentioned topics below:

- How can a smoker get a health insurance policy?

- Are there different health insurance plans for smokers & non-smokers?

- Why does a smoker need health insurance?

- Reasons for Claim Rejection for Smokers

How can a smoker get a health insurance policy?

The use of nicotine in any form is determined as a smoker by the health insurance companies. Before presenting the premium amount, insurers insist on a medical test for detecting the traces of nicotine in your body and general health condition.

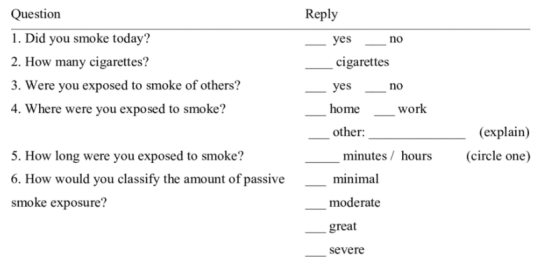

When you intend to sign up for a health insurance plan, the insurers frame questions about your smoking habits, like:

Along with the result of these questions, insurers also consider age when offering a sum for your health insurance. The most important thing is to be upfront regarding any updates on lifestyle changes so that you don’t face any problems during the claim process.

Not only this, but insurers also focus on the seriousness of pre-existing lifestyle diseases like hypertension and diabetes.

Now there are people who don’t smoke on a regular basis and have no pre-existing illness and are generally in the category of fit. These people can easily avail the privilege of online health insurance. As per economic times, “Consumption of 20-40 cigarettes a day are more prone to get rejections from health insurance companies”.

Are there different health insurance plans for smokers & non-smokers?

Health Insurance companies offer similar plans to both smokers and non-smokers. The only difference that comes in between is the consumption of tobacco daily. People who are habitual of smoking 2-4 cigarette packets a day are prone to rejection. Whereas, people who smoke less than 10 cigarettes a day receive loaded premiums.

There are a few health insurance plans firms that provide you with cessation programs, in which if you gave up smoking for 2 years then your premium will go down!

Why does a smoker need health insurance?

As a result of smoking, many smokers in the future might end up having illnesses. There are ample illnesses that are caused due to habits of smoking like respiratory issues, stroke, lung cancer, heart disease, hypertension, etc. Don’t fall into this assumption that the policy will get rejected because of your smoking habits.

Instead, give it a chance, go through the medical test and make proper and honest disclosures.

Reasons for Claim Rejection for Smokers

Many smokers have a perception that their claims would be partially or fully rejected if they avail of health insurance. Well, it doesn’t work like that.

According to a survey, the majority of people give false statements in order to get their health insurance. For instance, if a person smokes and he denies to the insurers at the time of buying a policy, he would have saved the premium, but ultimately, he will face problems in the claim. If this fact gets disclosed by the insurer, they have the full right to reject the claim.

Not only this, if you don’t update your lifestyle changes and be dishonest regarding it, then the also insurer rejects the claims. Many health insurers, especially in the case of smoking, conduct a medical test at the time of claims too! If you have declared them of having 2 cigarettes a day but end up having 6-7, this will be detected in the test. These medical tests will show up the nicotine content in your blood and urine tests.

Bottom Line:

Smoking is definitely harmful and is prone to multiple illnesses, but when faced with those illnesses at least you’ll be financially prepared. You’ll have the best affordable health insurance to help you in this scenario.

The only main deal with health insurance is, especially when you are a smoker is to be extremely honest with all the facts that you give while signing up for a health care insurance policy!