Table of Contents

Toggle“You don’t buy life insurance because you are going to die, but because those you love are going to live”

Would you like to eat melted ice cream? I believe you don’t.

Why do you eat ice cream as soon as it is served? Simply, because it tastes better when it’s frozen. The earlier you eat it, the more you can enjoy its taste. The more you wait, the less you’ll enjoy.

Similarly, buying a Term Plan in your 20s would benefit you the same way. The earlier you get it, the more benefits you can avail of from it.

The 20s is the age where some of you might be looking for job opportunities or focusing on your career. This is the age where we start to feel more independent. You also become more aware of managing your finances. Getting term insurance for your family in your 20s is the most sensible decision.

In this blog, we’ll be covering the topics mentioned below:

1.Meaning and Importance of a Term Insurance

2.Benefits for being an Early Bird

Meaning and Importance of a Term Insurance

Term Insurance is nothing but an income substitution. You pay a premium for the life insurance cover and God forbid if the life assured/person dies, the family gets the huge sum of money as a death claim. The amount helps the legal heirs/ other family members to live comfortably.

It is a pure risk protection insurance cover. Term Insurance charges a very low premium but has a very high sum assured (life insurance cover).

For instance, a healthy, non-smoker person can get an insurance cover for Rs. 1 Crore by just paying say 8000/- per annum.

Benefits for being an Early Bird

As stated above there are abundant benefits of being an early bird for purchasing a term insurance plan for your family:

- Lower premiums at a younger age

This is the most crucial benefit you get in being in your 20s. When you are in the process of purchasing term insurance, the first thing they assess is the risk. For them, assessing risk is a crucial part, this way, they’ll know the payout in terms of money you have in your coverage.

In your 20s are considered to be healthier and more active, you are probably not prone to any pre-existing illness. The younger you are the less risk insurance companies have to face. Secondly, the younger you are the less premium for a high coverage you’ll get.

Insurance companies decide the rate of premiums depending on your age.

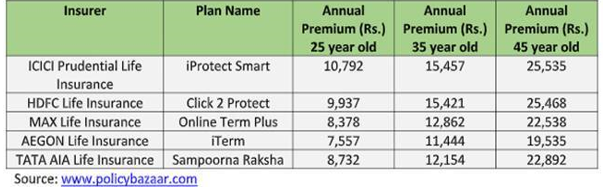

In this table below, comparisons have been made for different age categories; 20s, 30, 40s, by 5 prominent insurers. This distinction is made for the sum coverage of Rs. 1 crore.

You can see how becoming an early bird can benefit you drastically!

- Stay protected for a longer duration

Term insurance’s other entitlement is that it not only provides you with the benefit of low premiums but also allows a longer period of cover. For instance, if at the age of 25 you bought term insurance you could enjoy the coverage benefits for almost 50 years. If you purchase it at the age of 40 then you could only enjoy benefits till 35 years max.

The longer duration aims to financially secure you and your family for upcoming stages of life.

- Protect your family in your absence

Protecting your family is very crucial. There might be a scenario where your family might not be dependent in your 20s. But what if they are? There might be parents and siblings who might be dependent on you financially as well as emotionally.

Having term insurance to secure their future, financially, is something you should do for them, especially when you’re the sole breadwinner of the family. God forbid something happens to you, then there will be the payout of the term plan that will help them cope financially. You will have peace of mind thinking your family will be financially secured after you