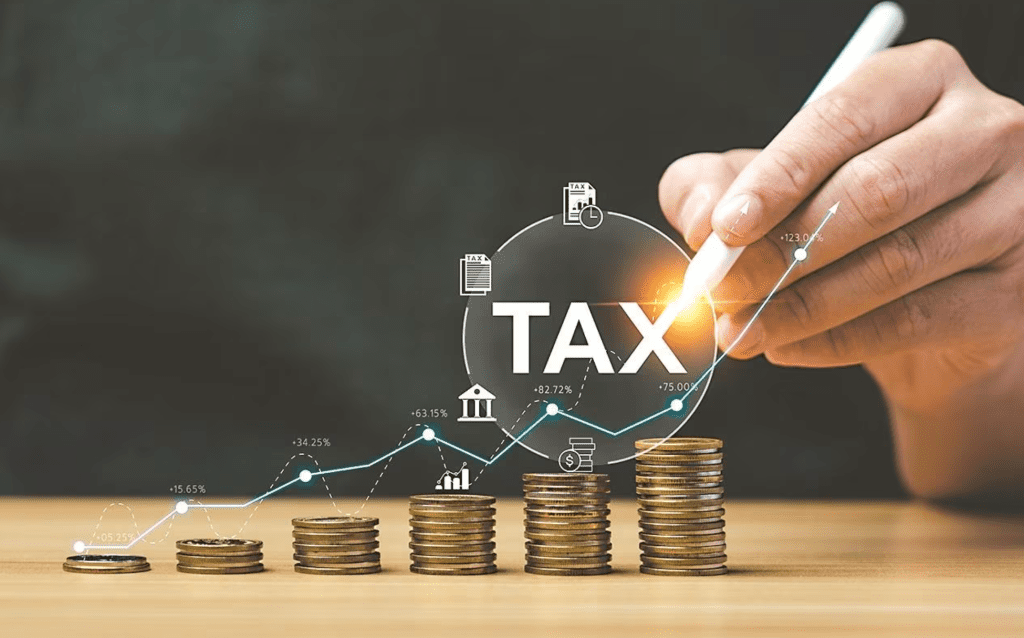

Revised Income Tax Slabs under the New Regime for FY 2024-25 (AY 2025-26)

The new tax regime offers revised slabs aimed at reducing the tax burden:

- Income up to ₹3,00,000: Nil

- ₹3,00,001 – ₹7,00,000: 5%

- ₹7,00,001 – ₹10,00,000: 10%

- ₹10,00,001 – ₹12,00,000: 15%

- ₹12,00,001 – ₹15,00,000: 20%

- Above ₹15,00,000: 30%